Running a successful towing and recovery business requires specialized tow truck insurance to protect against unique risks. This includes towing business insurance with tow truck liability coverage for property damage and personal injury, roadside assistance insurance for customer service enhancements, and comprehensive tow vehicle insurance to safeguard against mechanical failures. These measures ensure financial security, operational continuity, and peace of mind in an unpredictable industry. Investing in tailored tow truck coverage, including towing service insurance, allows businesses to focus on reliable service while minimizing potential losses from accidents or breakdowns.

In the high-risk and dynamic world of towing and recovery businesses, ensuring full coverage is paramount. This comprehensive guide delves into the essential aspects of tow truck insurance, towing business insurance, and comprehensive tow truck coverage. From understanding stringent tow truck liability requirements to exploring the benefits of roadside assistance insurance, this article equips owners with knowledge to navigate risks effectively. Discover key components for a robust risk management strategy, enabling your towing service to thrive with peace of mind.

- Understanding Tow Truck Insurance Requirements

- Key Components of Comprehensive Tow Truck Coverage

- Protecting Your Business with Roadside Assistance Insurance

- Mitigating Liability Risks for Towing Services

Understanding Tow Truck Insurance Requirements

Running a successful towing and recovery business requires more than just reliable vehicles and skilled operators; it demands comprehensive insurance coverage to protect against potential risks and financial losses. Tow truck insurance, also known as towing business insurance or tow vehicle insurance, is tailored to meet the unique needs of this demanding industry. This specialized coverage goes beyond basic auto insurance, offering protection for a range of scenarios specific to towing operations.

Key components of comprehensive tow truck insurance include liability coverage to safeguard against claims related to property damage or personal injury during towing, as well as roadside assistance insurance to provide support services when customers are stranded. Additionally, this insurance may cover the cost of recovering and transporting vehicles, ensuring that businesses are prepared for any situation that arises on the road. By securing adequate tow truck coverage, operators can ensure the financial security of their business and minimize disruptions caused by unexpected events.

Key Components of Comprehensive Tow Truck Coverage

Running a towing and recovery business comes with unique risks that require specialized coverage. Comprehensive tow truck insurance should encompass several key components to ensure complete protection against potential losses and liabilities. Firstly, towing business insurance must include liability coverage to safeguard against damages caused to third-party vehicles or property during the towing process. This is crucial, as accidents can lead to significant legal repercussions and financial burdens.

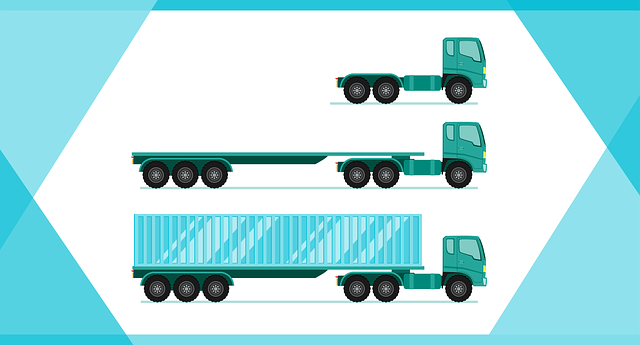

Additionally, consider incorporating roadside assistance insurance into your tow truck coverage. This not only protects your business but also enhances customer satisfaction by offering a valuable service. Furthermore, comprehensive tow vehicle insurance should be considered to protect against mechanical failures or damage to your tow trucks, ensuring your fleet remains operational and minimizing downtime.

Protecting Your Business with Roadside Assistance Insurance

In the demanding world of towing and recovery services, where unexpected incidents on the road can occur at any moment, having robust insurance coverage is paramount to safeguarding your business. Roadside assistance insurance, a specialized policy tailored for tow truck operators and towing businesses, offers comprehensive protection against various risks unique to this industry. This type of insurance goes beyond basic liability by including crucial coverages such as vehicle towing and roadside rescue operations, ensuring that you’re prepared to assist stranded drivers while mitigating potential financial losses.

Comprehensive tow truck insurance packages typically encompass not just the physical aspects of your business but also legal liabilities arising from accidents or damage during towing processes. This includes protection against property damage, personal injury, and liability for any towing-related incidents. By investing in this specialized coverage, you create a safety net that enables you to focus on providing reliable services while knowing your business is shielded from potential financial calamities.

Mitigating Liability Risks for Towing Services

Running a towing and recovery business comes with unique risks that demand tailored coverage to mitigate potential losses. As tow truck operators, every trip involves navigating unpredictable road conditions and sometimes hazardous situations, exposing your business to significant liability. Tow truck insurance is not just about protecting your vehicle; it’s a crucial shield against claims of property damage, personal injury, or even death during the towing process. Comprehensive tow truck coverage should include liability protection that covers medical expenses, legal fees, and damages arising from accidents involving your tow trucks and trailers.

Moreover, considering the nature of your work, roadside assistance insurance can be invaluable. This type of insurance ensures you’re prepared for roadside emergencies, such as flat tires or mechanical failures, by providing services like battery boosts, tire changes, and fuel delivery. Protecting your business from these everyday risks is essential, as it allows you to focus on delivering reliable towing services while minimising potential financial setbacks caused by accidents or unexpected breakdowns.

Running a successful towing and recovery business requires not just reliable vehicles and skilled operators but also robust insurance coverage. By understanding the key components of tow truck insurance, including comprehensive coverage, roadside assistance, and liability protection, businesses can navigate risks effectively. With the right policies in place, owners can ensure their investment is protected, provide peace of mind for employees, and offer unparalleled service to customers, solidifying their position in a competitive market.